As a business owner mistreatment QuickBooks Payroll, you actually wouldn’t need your staff to be malcontent due to incorrect payroll. After all, a wrong bank check will do loads of harm to your workforce’s morale and consequently, it’s productivity. it should not essentially ensue to human error either; generally, there could also be QuickBooks payroll issues that cause errors in conniving the paychecks.

These problems will happen regardless of whether or not you pay employees on an associate hourly basis or once a month as a wage. whereas it should take simply a few minutes to repair the difficulty, you will not even understand what mistake is inflicting a selected downside. this can be why it’s necessary to seek out out the basis cause 1st then attempt to solve or undo the error. To solve these error you can contact QuickBooks support team experts.

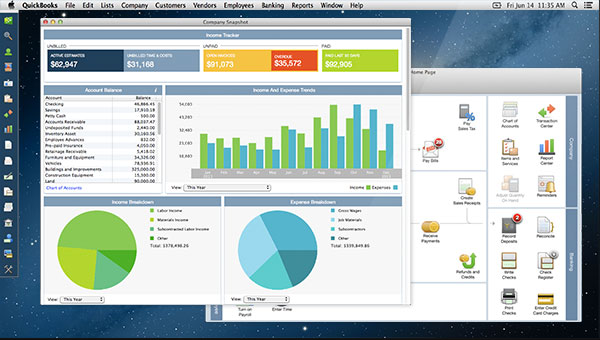

It may appear tough to single out the supply of the matter, that’s unless you’ve got QuickBooks Payroll. In any case, you would like to look at all the payroll tasks that are being done on a routine basis which can not solely lead you to the cause however additionally ultimately improve yours likewise as your employees’ satisfaction.

Table of Contents

Common QuickBooks Payroll issues that may Cause Mistakes

No matter what edition of this accounting payroll answer you will be mistreatment, it will still get errors. However, these are straightforward to trace and acquire eliminate due to the codes that are displayed within the dialogue box. These codes permit you to trace back to the supply of the actual error.

The first factor you’ll be able to do is check your application, just in case, you will be obtaining payroll issues due to any anomalies within the program. Here could be a list of the foremost probable causes for QuickBooks Payroll problems-

- Your folder contains corrupt or broken information files just like the tax table files or the corporate file.

- If your QuickBooks Payroll is unregistered, then that may actually produce problems.

- Someone has entered the incorrect asking details.

- You opened the incorrect file to enter bound data, that happens once making an attempt to line staff up for deductions or paychecks.

- QuickBooks is also showing one amongst these error codes-

- PS077

- PS032

- PS107

- 15240

- PS058

It May Not be due to QuickBooks Payroll issues

What if your program is running swimmingly and doesn’t show any signs of any error? may or not it’s that you simply or another user has created a misreckoning or a mistake? Human errors aren’t uncommon and want to be fastidiously analyzed. that’s up to you to search out however there are a couple of areas that you’ll return 1st so as to and take a look at to retrace your steps.

Given below are a number of the areas wherever there’s unremarkably scope for error-

Government Holidays and different Interruptions

Employers should remember of the coming state or federal holidays as a result of the banks can all be closed on such dates. this could cause delays within the payroll and so, should be identified beforehand.

It is additionally necessary to tell just in case the date of payroll distribution has been revived thanks to vacation. this may forestall any disruptions from occurring for people who keep their schedules relating to due dates for pay periods written.

Resignations or Terminations

States typically have bound laws for paydays to confirm that staff gets paid on time and while not fuss. They typically specify the dates for those staff who get paid double a month, typically the primary and also the fifteenth of any given month. They urge employers to form those dates visible to any or all the staff by posting notices.

There also are directions in these laws for special cases like worker termination or resignation. it’s necessary that each leader is conscious of and clearly understands these laws to follow them properly and keep staff glad.

Faults in Communication with Human Resources

Every once in a very whereas, there square measure problems with the server or different technical glitches that aren’t essentially thanks to human error. The server-related hassle will lead the payroll to be delayed or may be known as off accidentally. Such problems can even cause QuickBooks Payroll issues, that is feasible however aren’t that common.

Still, it’s higher to take care of a secure backup or hand the payroll responsibilities over to a 3rd party altogether, looking on the size of your business and also the potency of your current payroll system.

Incorrect Time Stamps and Records

Many businesses have automatic readers that square measure corrects on their half. However, some types of errors are inevitable, for instance, if the staff themselves forget to induce their time cards to browse at the tip of their shift or if their time cards square measure misread.

Exceptions like these could prompt you to induce it slow records monitored and checked for errors, ideally by a payroll specialist or somebody from the relevant department.

Overlapping worker Leaves

Employees could proceed to leave thanks to family or health-regarding troubles from time to time. These leaves are coated by the Family Medical Leave Act however if they’re getting used in a very discontinuous manner, they’ll be confusing to calculate at the time of payroll.

There are specialists dealing in human resources’ edges who will effectively manage staff leave cases and expeditiously coordinate them. If you have got already delegated these tasks to them, you would like to form positive that everyone changes are being properly communicated to the payroll professionals to form the required changes and avoid QuickBooks Payroll issues.

Differences in Compensation

When employers reward their staff at the time of appraisal, there’s typically a rise in their pay. This involves the data regarding the appraisal and increment to be communicated to the payroll.

Any delay during this communication can, in turn, replicate within the calculation of aforesaid increase and changes into the paychecks. this can be why it’s well for appraisals to be effective from a date before they need to be been declared in some cases.